Professional Guidance: Bagley Risk Management Approaches

Professional Guidance: Bagley Risk Management Approaches

Blog Article

Recognizing Animals Risk Protection (LRP) Insurance Coverage: A Comprehensive Guide

Navigating the realm of livestock danger security (LRP) insurance policy can be an intricate endeavor for numerous in the farming sector. From exactly how LRP insurance works to the numerous insurance coverage options readily available, there is much to reveal in this comprehensive overview that can possibly form the method animals producers come close to risk monitoring in their organizations.

How LRP Insurance Policy Works

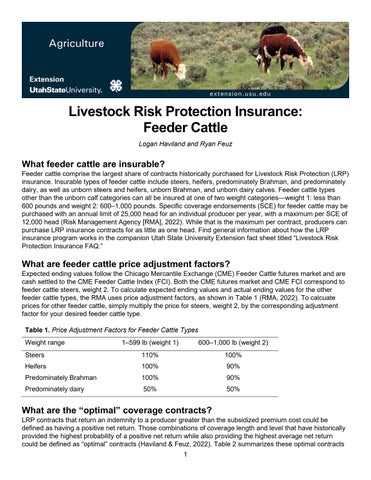

Periodically, comprehending the auto mechanics of Livestock Threat Security (LRP) insurance coverage can be intricate, yet damaging down exactly how it works can provide clarity for farmers and ranchers. LRP insurance coverage is a threat monitoring tool made to shield animals producers versus unforeseen rate declines. The plan permits manufacturers to set an insurance coverage level based upon their particular demands, selecting the number of head, weight variety, and coverage cost. Once the policy is in location, if market rates drop below the insurance coverage price, producers can file an insurance claim for the difference. It is necessary to note that LRP insurance policy is not a profits assurance; instead, it focuses exclusively on rate risk security. The coverage period generally ranges from 13 to 52 weeks, giving adaptability for producers to pick a duration that straightens with their production cycle. By using LRP insurance policy, herdsmans and farmers can reduce the monetary risks related to rising and fall market value, ensuring higher security in their procedures.

Eligibility and Protection Options

When it involves coverage choices, LRP insurance uses manufacturers the versatility to select the insurance coverage level, coverage period, and endorsements that finest fit their threat management requirements. Protection levels typically vary from 70% to 100% of the expected finishing worth of the insured animals. Manufacturers can also select coverage durations that line up with their manufacturing cycle, whether they are guaranteeing feeder livestock, fed livestock, swine, or lamb. Recommendations such as price risk protection can better personalize insurance coverage to safeguard against negative market variations. By recognizing the eligibility requirements and protection options offered, animals manufacturers can make informed choices to handle danger effectively.

Pros and Disadvantages of LRP Insurance

When examining Livestock Risk Protection (LRP) insurance policy, it is crucial for livestock producers to consider the disadvantages and advantages fundamental in this risk administration tool.

One of the main advantages of LRP insurance is its ability to offer defense against a decline in livestock prices. Additionally, LRP insurance offers a level of flexibility, permitting manufacturers to tailor coverage levels and plan periods to match their details demands.

However, there are likewise some disadvantages to think about. One restriction of LRP insurance is that it does not safeguard against all kinds of risks, such as disease episodes or all-natural disasters. Moreover, premiums can sometimes be pricey, specifically for producers with large livestock herds. It is crucial for producers to carefully assess their specific danger exposure and economic circumstance to figure out if LRP insurance coverage is the best threat monitoring tool for their operation.

Comprehending LRP Insurance Policy Premiums

Tips for Making The Most Of LRP Perks

Optimizing the advantages of Livestock Threat Defense (LRP) insurance coverage calls for strategic planning and positive danger monitoring - Bagley Risk Management. To maximize your LRP coverage, think about the adhering to tips:

Regularly Assess Market Conditions: Remain notified about market patterns and price changes in the animals sector. By checking these aspects, you can make educated choices regarding when to buy LRP protection to shield against potential losses.

Establish Realistic Insurance Coverage Degrees: When choosing protection levels, consider your production costs, market price of animals, and prospective dangers - Bagley Risk Management. Establishing realistic coverage degrees ensures that you are adequately safeguarded without overpaying for unnecessary insurance coverage

Diversify Your Coverage: Rather of relying entirely on LRP insurance, take into consideration diversifying your danger management techniques. Combining LRP with other risk monitoring devices such as futures agreements or choices can offer extensive coverage versus market unpredictabilities.

Evaluation and Readjust Protection Regularly: As market conditions transform, periodically evaluate your LRP insurance coverage to ensure it straightens with your present threat exposure. Readjusting insurance coverage degrees and timing of acquisitions can aid optimize your risk security strategy. By complying with these ideas, you can take full advantage of the benefits of LRP insurance policy and safeguard your animals operation versus unexpected risks.

Verdict

To conclude, animals risk defense (LRP) insurance coverage is a beneficial device for farmers to take care of the economic visit risks connected with their livestock operations. By recognizing how LRP functions, eligibility and insurance coverage options, as well as the benefits and drawbacks of this insurance policy, farmers can make informed choices to secure their source of incomes. By meticulously thinking about LRP costs and executing methods to make the most of benefits, farmers can mitigate prospective losses and make sure the sustainability of their procedures.

Animals producers interested in obtaining Livestock Danger Defense (LRP) insurance can check out a variety of eligibility requirements and coverage choices customized to their particular livestock operations.When it comes to protection alternatives, LRP insurance provides producers the adaptability to pick the insurance coverage degree, insurance coverage duration, and recommendations that finest suit their risk management needs.To understand the details of Livestock Threat Defense (LRP) insurance fully, comprehending the elements influencing LRP insurance policy costs is crucial. LRP insurance costs are identified by different elements, consisting of the protection level picked, the anticipated cost of livestock at the end of the coverage duration, the type of animals being guaranteed, and the length of the coverage duration.Testimonial and Readjust Coverage On a regular basis: As market conditions change, occasionally examine your LRP coverage to ensure it aligns with your existing risk exposure.

Report this page